The E‑Way Bill is an electronic document that you must fill out and submit when transporting goods within India. It is required for goods valued more than ₹50,000. To fill this E‑Way Bill, you must visit the official site ewaybillgst.gov.in before commencing the movement of goods. Also, the E‑Way Bill system is mandated under the Goods and Services Tax (GST) laws. Specifically, section 68 of the GST Act, read with Rule 138 of the GST Rules.

But how do you get started with the E‑Way Bill process? Well, the first step to generating the E‑Way Bill requires an E‑Way Bill filing of FORM GST EWB‑01. This can be a complex process if you are not aware of it. If you find filing an E‑Way Bill daunting, don’t worry.

In this article, we’ll answer what an E‑Way Bill is and how it works, along with the details on how to make an E‑Way Bill, the documents to include, and much more. Read on and navigate the process effectively to understand the E‑Way Bill format and its filling process. Let’s start by answering some basic questions first.

- Who Needs an E‑Way Bill?

- Benefits of E‑way Bill Format

- When to Generate an E‑Way Bill?

- What is the Validity of the E‑Way Bill?

- What Fields Should Be Included in the Document?

- Step‑by‑Step Guide on Creating and Filling Out the E‑Way Bill

- E‑Way Bill Format in Different File Types

- E‑way Bill: Typical Mistakes and Ways to Avoid Them (and Penalties)

- Frequently Asked Questions

Who Needs an E‑Way Bill?

Nowadays, businesses often process sales and purchase orders (POs) through a systematic order management system like an app or software. This is true for businesses transporting goods to the same or different states within India, as they’ll be required to generate POs, E‑Way Bills, and other documents to comply with the transport regulations.

The onus of generating an E‑Way Bill lies on different parties involved in transporting goods, as mentioned below.

Registered Person (Supplier or Recipient)

If a registered person (under GST) transports goods in their own or hired conveyance by rail, air, or vessel, they are liable for generating the E‑Way Bill. This is applicable whether they are the supplier (consignor) or the recipient (consignee) of the goods.

Transporter

When goods are handed over to a transporter for transportation, the transporter generates the E‑Way Bill using the E‑Way Bill full form.

The registered person should furnish the transporter with the essential details to generate the E‑Way Bill on the common portal.

Unregistered Suppliers

In cases where the supplier is unregistered, the recipient or the transporter of the goods is responsible for generating the E‑Way Bill.

Exemptions from Generating an E‑Way Bill

There are specific scenarios where generating an E‑Way Bill is not required:

- Small Consignments: Transporters do not need to generate an E‑Way Bill (Form EWB‑01 or EWB‑02) if each consignment in the conveyance is valued at Rs 50,000 or less, even if the total value of all consignments exceeds Rs 50,000.

- Unregistered Transporters: Upon enrolling on the E‑Way Bill portal, they are issued a Transporter ID, which they can use to generate E‑Way Bills.

Situations Where an E‑Way Bill is Not Required

There are different circumstances wherein you are not required to file an E‑Way Bill. Here are those:

- Non‑Motor Transport: When goods are transported via non‑motorized vehicles.

- Customs Movements: When you move goods from a customs port, airport, air cargo complex, or land customs station to an Inland Container Depot (ICD) or Container Freight Station (CFS) for customs clearance.

- Under Customs Supervision: Goods transported under customs supervision or seal.

- Customs Bond Movements: Goods transported under a customs bond from an ICD to a customs port or between two customs stations.

- Transit Cargo: Goods in transit to or from Nepal or Bhutan.

- Defense Formations: Movements by defense formations under the Ministry of Defense as consignor or consignee.

- Empty Cargo Containers: When transporting empty cargo containers.

- Weighbridge Movements: Goods transported to or from a place of business to a weighbridge within 20 kilometers, provided it has a delivery challan.

- Government Consignments by Rail: Goods transported by rail where the consignor is the Central Government, State Governments, or a local authority.

- State/Union Territory Exemptions: Goods specified as exempt from E‑Way Bill requirements under the respective State/Union Territory GST Rules.

- Specified Goods: Transport certain specified goods, including exempt supply of goods, goods treated as no supply under Schedule III, and certain goods listed in the Central Tax Rate notifications.

Note: Part B of the E‑Way Bill must not be filled if the distance between the consignor/consignee and the transporter is less than 50 km and the transportation is within the same state.

Now that you know whether or not you need to fill out the E‑Way Bill full form, let’s understand the E‑Way Bill format. First, we’ll dive into its benefits and then explore the E‑Way Bill form fields, E‑Way Bill examples, and much more.

Exploser the features of Kladana Online Ordering System. Learn how it can help you streamline your ordering process, enhance customer satisfaction, and boost your business performance.

Benefits of E‑Way Bill Format

The E‑Way Bill format has many advantages that contribute to streamlining the process of goods transportation and ensuring compliance with GST regulations.

Here are some of the key benefits:

Simplified Documentation

- Consolidated E‑Way Bills: The E‑Way Bill format contributes to creating a single consolidated document for multiple consignments in a single vehicle, reducing paperwork for transporters.

- Digital Convenience: E‑Way Bills are electronic, eliminating the need for physical copies and streamlining the documentation process.

Enhanced Efficiency and Transparency

- Reduced Transit Time: The E‑Way Bill system reduces delays at checkpoints that promote faster transportation of goods.

- Real‑Time Tracking: The electronic format enables real‑time tracking of goods movement, improving transparency in the supply chain.

- Improved Compliance: The E‑Way Bill ensures strict adherence to GST regulations, reducing the risk of tax evasion and misuse of input tax credits.

Streamlined Logistics

- Optimized Supply Chain: Real‑time data on goods movement promotes better planning and optimization of the supply chain.

- Cost and Time Savings: Provides a streamlined process that reduces transportation costs and time by minimizing delays and paperwork.

User‑Friendly Interface

- Easy Generation: The E‑Way Bill portal provide E‑Way Bill excel format download along with doc E‑Way Bill and PDF format. This contributes to a user‑friendly options for generating E‑Way Bills.

- Accessible Information: The E‑Way Bill formats clearly outline the required fields and information, which makes it easier for businesses to follow the regulations.

Government Oversight

- Effective Monitoring: The E‑Way Bill system offers the government valuable data for monitoring the movement of goods and identifying potential tax evasion.

- Data‑Driven Policymaking: The data collected through E‑Way Bills help formulate better policies for the logistics and transportation sector.

Simplified E‑Way Bill Documentation

- Consolidated E‑Way Bills: The E‑Way Bill format enables consolidating several individual bills into one transportation (if there’s one vehicle). This streamlines the documentation process by reducing the volume of paperwork and simplifying logistics management.

- Digital Convenience: E‑Way Bills are electronic, eliminating the need for physical copies and streamlining the documentation process.

When to Generate an E‑Way Bill?

Generating an E‑Way Bill is mandatory before initiating the transportation of goods in India. Non‑compliance can cause penalties which we’ll examine later. This ensures legal compliance and proper tracking of goods movement.

As a key rule, you must have an E‑Way when the value of the goods being transported exceeds Rs. 50,000. This value can be either per invoice or aggregate for multiple invoices in a single vehicle or conveyance.

The E‑Way Bill system serves several essential purposes within the Indian GST framework:

Tracking Goods Movement

The primary reason to generate the E‑Way Bill is to enable the government to track the movement of goods across the country. Once you generate the purchase order, the next step is safeguarding its transportation and taking the necessary steps.

You can download our purchase order templates with a step‑by‑step guide for Excel, Word, and Google Sheets format. Sellers can use this to generate the PO and then move ahead with E‑Way Bill generation, ensuring real‑time goods tracking.

This real‑time tracking helps in:

- Preventing Tax Evasion: The E‑Way Bill system restricts businesses from transporting goods without proper documentation, reducing the scope for tax evasion.

- Curbing Misuse of Input Tax Credit: Verifying the actual movement of goods through an E‑Way ensures that businesses claim Input Tax Credit (ITC) only for genuine transactions.

- Enhancing Transparency: The E‑Way Bill promotes transparency in the supply chain, making it easier for authorities to monitor the flow of goods and recognize any irregularities.

Efficient Logistics

The E‑Way Bill eligibility ensures streamlining the transportation process by eliminating the need for multiple checkposts and permits.

This results in:

- Faster Transit: Goods can move quickly through checkpoints, reducing transportation time and costs.

- Reduced Paperwork: E‑Way Bill is generated digitally, eliminating the need for physical documents and simplifying the documentation process.

Data Analytics and Planning

The E‑Way Bill system generates valuable data on the movement of goods, which can be used for:

- Data‑Driven Policy Making: The government can analyze E‑Way Bill data to craft better policies for the logistics and transportation sector.

- Infrastructure Planning: The data provided in an E‑Way Bill form is useful in pinpointing bottlenecks in transportation routes to plan infrastructure development accordingly.

When Should an E‑Way Bill Be Issued?

An E‑Way Bill must be generated in the following situations when the value of the goods being transported exceeds Rs. 50,000, either per invoice or in aggregate for multiple invoices in a single vehicle or conveyance:

In Relation to a Supply:

- For a Sale: Movement of goods due to a sale transaction where payment is made.

- For a Transfer: Movement of goods such as branch transfers.

- For Barter or Exchange: Goods are exchanged instead of payment in money.

For Reasons Other Than Supply:

- Return of Goods: When goods are being returned to the supplier.

Inward Supply from an Unregistered Person

When goods are received from an unregistered supplier.

For these purposes, ‘supply’ refers to various scenarios, including:

- Supply made for a consideration (payment) in the course of business.

- Supply made for a consideration, which may not be in the course of business.

- Supply without consideration (without payment).

In no‑frills words, an E‑Way Bill is critical for sales, transfers, and barter/exchange trades.

Besides, there are E‑Way rules for certain specified goods that demand you fill out the E‑Way Bill form even if the consignment value is less than Rs. 50,000.

These specified goods include:

- Inter‑State Movement of Goods: From the principal to a job‑worker or by a registered job‑worker.

- Inter‑State Transport of Handicraft Goods: By a dealer exempted from GST registration.

Read‑alikes

GST Invoice Template: download in Excel and Word Format

4 Free Purchase Order Templates with a Step‑By‑Step Guide: Excel, Word, and Google Sheets Format

Inventory Management in Excel: Free Template and a Step‑by‑Step Guide

What is the Validity of the E‑Way Bill?

The validity of an E‑Way Bill hinges on the distance the goods need to transit. As per the regulations, the E‑Way Bill form will remain valid for one day for every 100 kilometers or part thereof.

For example:

If the goods are transported for a distance of 250 kilometers, the E‑Way Bill will be valid for 3 days (2 days for the first 200 kilometers and 1 day for the remaining 50 kilometers).

What Fields Should Be Included in the Document?

When generating an E‑Way Bill, including specific fields to ensure that all necessary information is documented accurately is essential. Pay close attention to the E‑Way Bill description, where different fields in the form need to be filled out brevity.

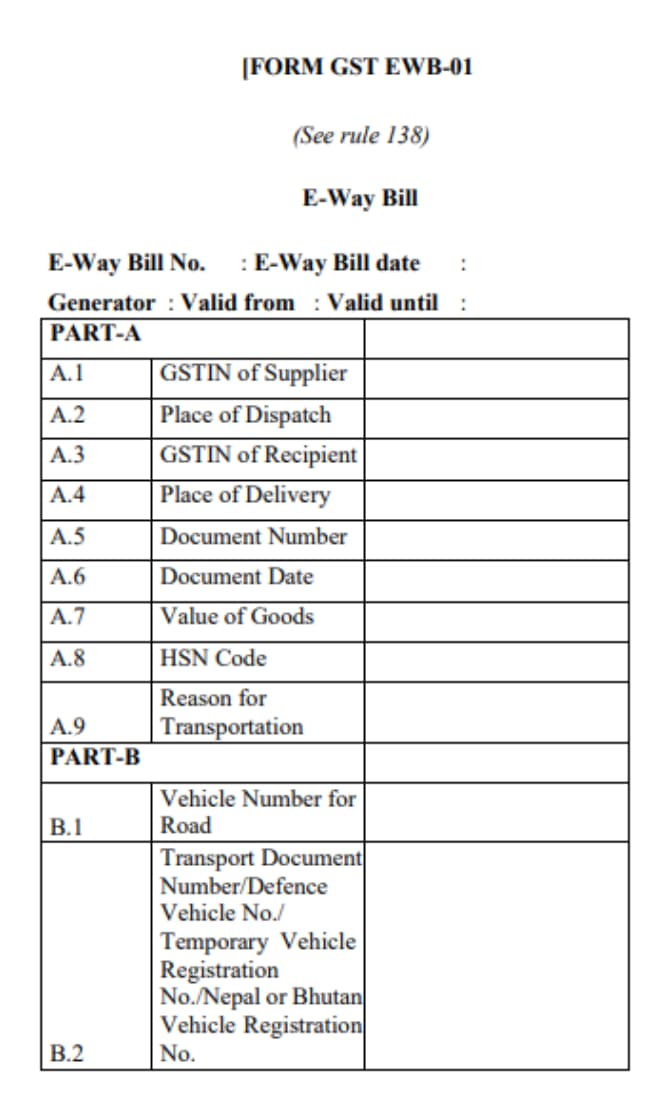

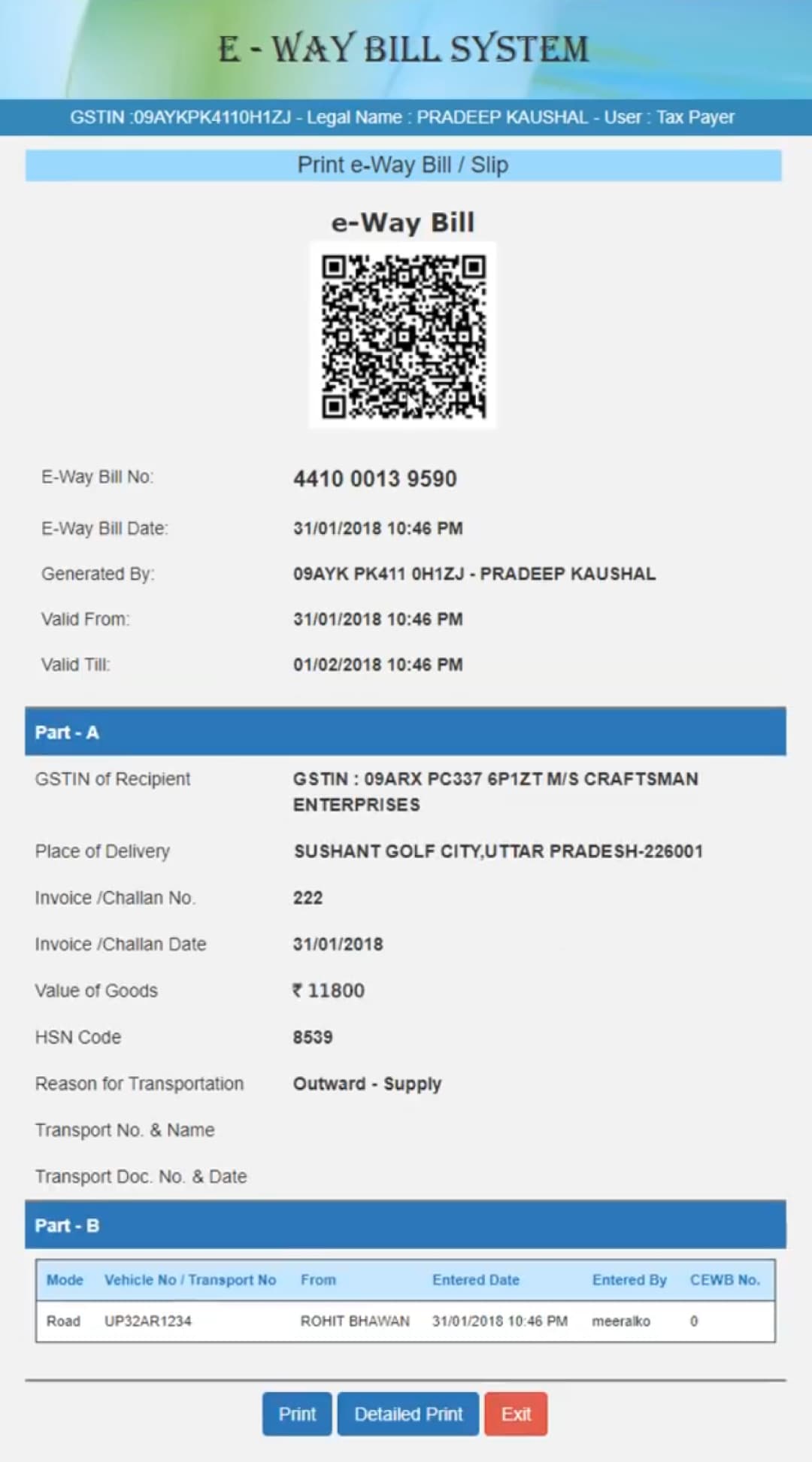

Let’s check out how the E‑Way Bill form looks.

Let’s quickly discuss the key fields included in the FORM GST EWB‑01.

Part A: Details of the Consignment

The key section where you must fill E‑Way Bill details is the Part A form. This requires providing full details about the consignment, including details about the supplier, recipient and transported goods.

This section ensures that all necessary data is recorded for compliance and tracking purposes.

Let’s explore these in detail:

- GSTIN of Supplier: The GST Identification Number of the supplier.

- Place of Dispatch: The location from where the goods are scheduled to be dispatched.

- GSTIN of Recipient: The GST Identification Number of the recipient.

- Place of Delivery: The location where the goods are to be delivered.

- Document Number: The invoice or bill number for the consignment.

- Document Date: The date of the invoice or bill.

- Value of Goods: The total worth of the goods being transported.

- HSN Code: The Harmonized System of Nomenclature code for the goods.

- Reason for Transportation: Furnishing the reason for moving the goods like sales, return, job work, etc.

- Transporter Details: Information about the transporter, including their GSTIN (if registered), name, and ID.

Part B: Details of the Transporter

An E‑Way Bill description is required for Part B, which requires mentioning the transporter’s details.

Note that you will only need to fill Part B if the transporter differs from the supplier or recipient. It includes the transporter’s ID, transporter document number, and vehicle number.

Details of the Transporter

- Vehicle Number: The vehicle’s registration number for transporting goods.

- Transporter ID: The ID of the transporter if they are registered.

- Transporter Document Number: The document number provided by the transporter, such as the LR number.

- Transporter Document Date: The date of the document provided by the transporter.

Now that we know the benefits of the E‑Way Bill format and main forms where you need to furnish the E‑Way Bill details, the next action is to take a step‑by‑step approach to filing the form.

Let’s explore this up next.

Step‑by‑Step Guide on Creating and Filling Out the E‑Way Bill

Creating and filling out an E‑Way Bill involves ensuring that all necessary details are accurately captured and submitted.

Here’s our guide on E‑Way Bills that help through the process.

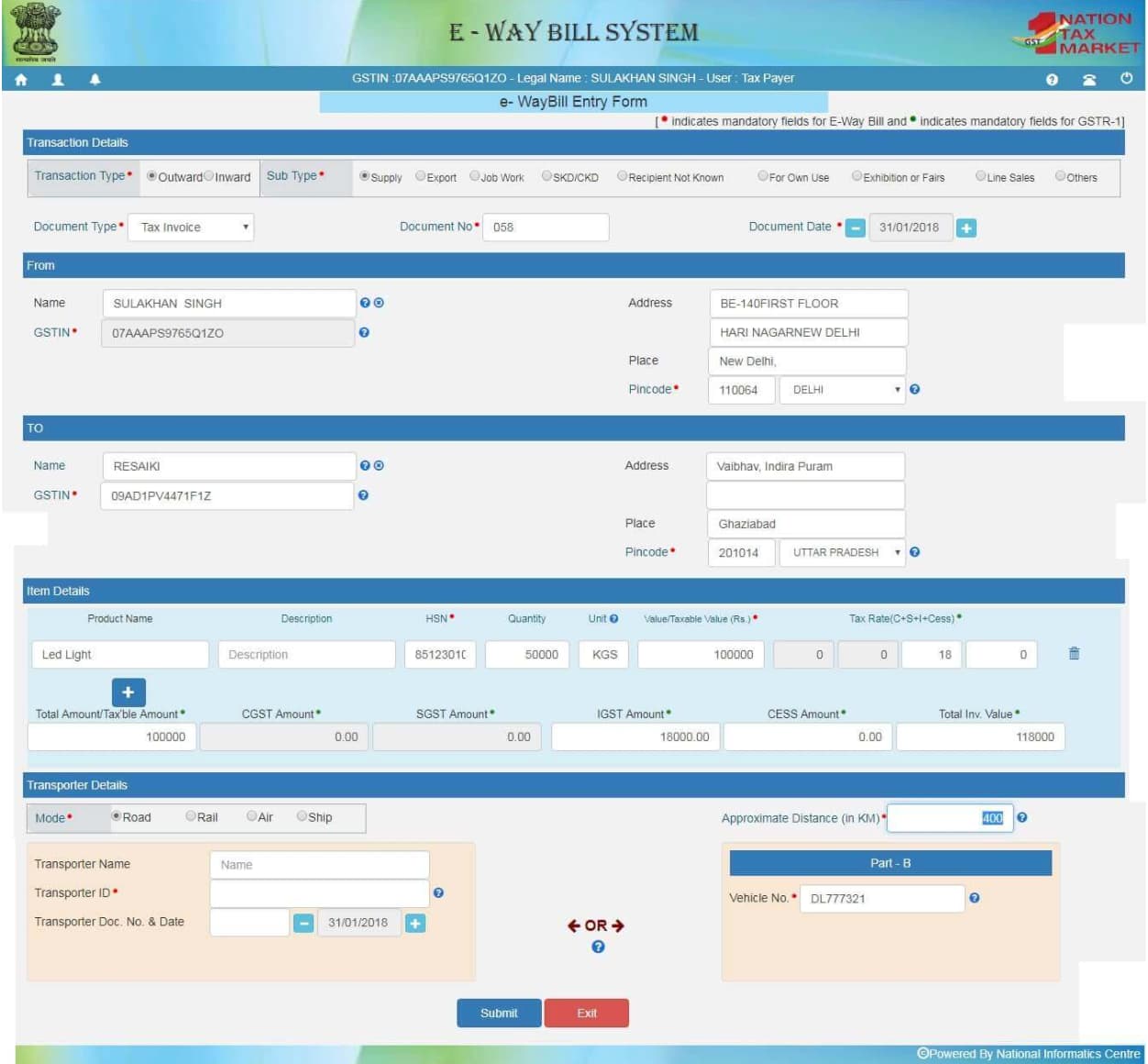

Step 1: Login to the E‑Way Bill Portal:

- Visit ewaybillgst.gov.in, the official site, to fill out the E‑Way Bill form. To do this, log in using your credentials. If new, create a new account by providing the GSTIN

Step 2: Navigate to E‑Way Bill Generation

- Select ‘Generate New’ under the ‘E‑Way Bill’ menu.

Step 3: Fill in the Required Details

- Complete Part A of the E‑Way Bill form with consignment details. Here, mention the supplier’s and recipient’s details along with the invoice number, date, and the value of goods.

Fill Part A (Basic Details)

- Transaction Type: Choose whether the movement is for outward supply, inward supply, or other reasons.

- Document Type and Details: Select the document type (tax invoice, bill of supply, etc.) and enter its number and date.

- From/To: Enter the complete address details of the starting point and destination, including PIN codes.

- Item Details: Provide a description of the goods, their quantity, unit, HSN code, and value.

- Transportation Details: Choose the mode of transport and enter the vehicle number (if applicable).

- Reason for Transportation (if applicable): Select the reason for transportation if it’s required for the specific goods.

- Bill to — Ship to (if applicable): Enter the billing and shipping addresses if they differ.

Transporter Details

This is form B, where you’ll see the key details as under:

- Here, you will have to enter the details of the transporter such as vehicle number and transporter ID.

- If a separate transporter is involved, enter their GSTIN, transporter ID, and vehicle number.

Submit and Generate

Finally, check the details again to confirm. Once done, submit and generate the form, which will look like this.

Ensure the following:

- Review all the entered details carefully.

- Click on ‘Submit’ to generate the E‑Way Bill.

- A unique E‑Way Bill Number (EBN) will be generated.

E‑Way Bill Format in Different File Types

Different E‑Way Bill formats are available in multiple file types, catering to various business needs and preferences.

These different E‑Way Bill formats ensure flexibility and ease of use, helping generate and maintain bills in the preferred document type.

Whether you prefer working with Excel, Word, PDF, or cloud‑based solutions like Google Docs and Google Sheets, there’s a format that suits your workflow.

E‑Way Bill Format in Excel

A popular choice due to its familiarity and data organization capabilities.

E‑Way Bills in Excel help create a custom template with pre‑defined fields, making the data entry efficient.

Do the following:

- Open a New Excel Worksheet: Open Excel and create a new worksheet named “E‑Way Bill”.

- Add Required Columns: Include columns for all necessary E‑Way Bill details, such as supplier and recipient information, item descriptions, HSN codes, quantity, unit, value, and tax details.

- Insert Formulas: Use formulas to automate the calculation of tax amounts based on the tax rate and taxable value.

- Save the File: After entering all required information, save the file in your preferred format, such as Excel or CSV.

E‑Way Bill Format in Word

An E‑Way Bill in MS Word provides a more document-oriented approach. While not ideal for complex calculations, it is suitable for creating visually appealing E‑Way Bills with clear formatting and easy readability.

Here’s what you’ll need to do:

- Open a New Word Document: Open a new document in Word and name it “E‑Way Bill”.

- Add Necessary Fields: Create fields for essential details such as supplier and recipient information, item descriptions, HSN codes, quantity, and value.

- Organize with Tables and Headings: Use tables to organize the information and headings to make it more readable.

- Save the Document: Once all the information is entered, save the file as a Word document or PDF.

E‑Way Bill Format in PDF

PDF is the standard format for sharing and printing documents, ensuring consistent display across different devices and platforms. You can generate E‑Way Bills in PDF format directly from the portal or convert files from Excel or Word.

Consider taking the following key steps:

- Start with Word or Excel: Create the E‑Way Bill in either Word or Excel, including all necessary details.

- Convert to PDF: Save the document as a PDF file once it is ready.

- Upload to GSTN Portal: Use the PDF document to upload the E‑Way Bill information to the GSTN portal.

E‑Way Bill Format in Google Docs

Use Google Docs for E‑Way Bill generation that provides real-time collaboration and easy access from anywhere with an internet connection. It’s convenient for teams working together on E‑Way Bills.

Here’s what you need to do:

- Open Google Docs: Create a new document and name it “E‑Way Bill”.

- Insert a Table: Use the Insert tab to add a table and include fields for all necessary E‑Way Bill details.

- Organize Information: Use headings to structure the information clearly.

- Save the Document: Once all details are entered, save and download the file in your preferred format.

E‑Way Bill Format in Google Sheets

Google Sheets is similar to Excel, offering a spreadsheet-like interface within the Google Workspace. Using Google Sheets for E‑Way Bills enables creating templates, performing calculations, and collaborating with others in real time.

- Open Google Sheets: Create a new spreadsheet and name it “E‑Way Bill”.

- Add Fields: Include columns for all required E‑Way Bill details.

- Use Headings: Add bold headings to make the information more readable.

- Save the Sheet: After entering all details, save the sheet in the desired format.

E‑Way Bill: Typical Mistakes and Ways to Avoid Them (and Penalties)

If not handled carefully, the E‑Way Bill system can be prone to errors. These mistakes can range from simple data entry issues to misunderstanding the regulations. The impact is delays in delivery, hefty fines, and even legal consequences.

This section outlines common pitfalls in E‑Way Bill generation and provides practical tips for accurate and compliant documentation.

Here are some common mistakes in filing E‑Way Bills and we’ll explore ways to avoid those.

- Single Bill for Multiple Consignments: Create a separate E‑Way Bill for each invoice, even if transported in the same vehicle.

- Incorrect Bulk Generation: When using the bulk generation facility, ensure proper data entry. Avoid using outdated templates and double‑check the information before uploading.

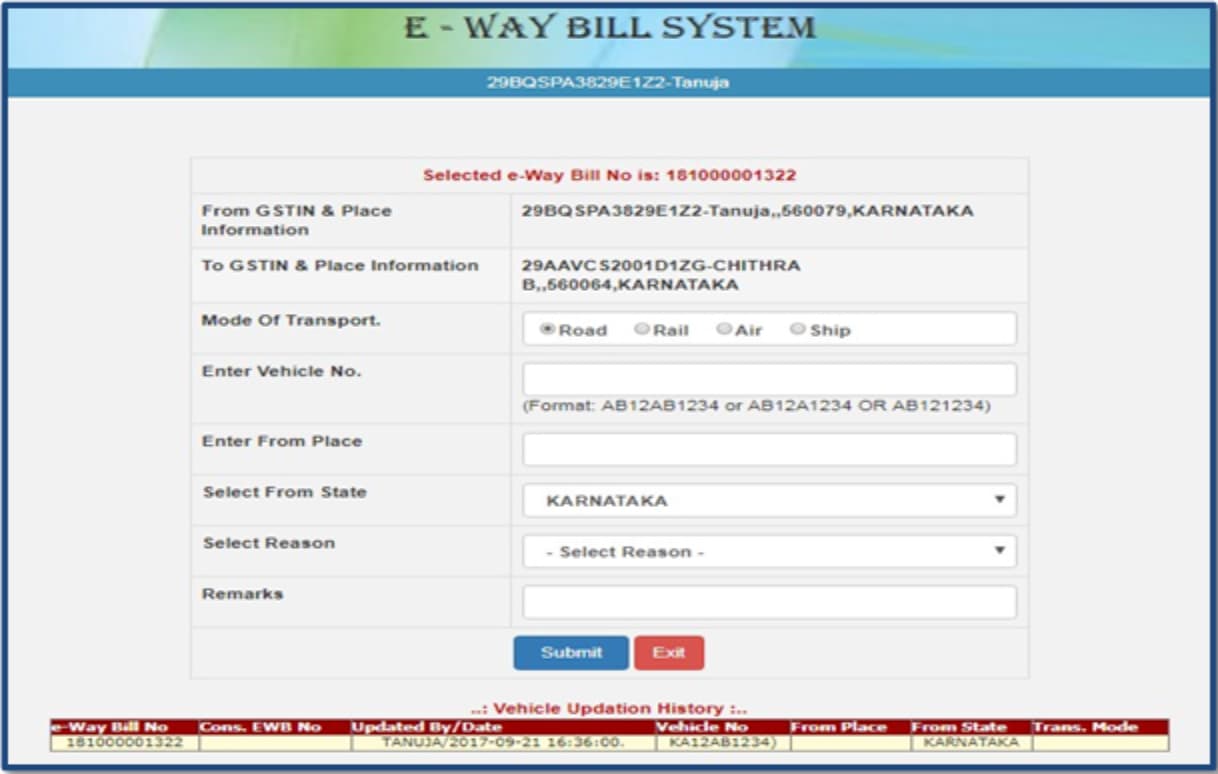

- Incorrect Vehicle Number: Verify the vehicle number entered in Part B to avoid issues during transportation.

- Missing Transporter Details: When applicable, provide accurate transporter details (ID, vehicle number) in Part B.

- Not Tracking Validity: To avoid penalties, monitor the validity of your E‑Way Bill and extend it if needed (within the allowed time frame).

- Incorrect User ID: Use the correct user ID associated with the relevant GSTIN to avoid errors.

- Poor Record-Keeping: Maintain proper records of E‑Way Bills generated by third parties, ensuring accurate GSTIN information.

- Wrong Documents: To prevent errors in the E‑Way Bill, upload the correct supporting documents (invoice, delivery challan, bill of supply).

- Incorrect Company Details: To avoid complications, double‑check company details, including GSTIN, address, and contact information.

Ways to Avoid Errors

Now that we know the common errors in filing E‑Way Bills, let’s also explore major ways you can avoid those.

- Automated Solutions: Integrate automated E‑Way Bill generation into your ERP systems to minimize manual errors.

- Thorough Verification: Always review all entered details before submitting the E‑Way Bill.

- Master Data Maintenance: Maintain accurate master data for clients, customers, products, and suppliers to pre‑fill information and avoid errors.

- Sub‑User Management: Train and manage sub‑users who generate E‑Way Bills on your behalf to ensure accuracy.

- Utilize Available Tools: Use SMS‑based and Android‑based E‑Way Bill management tools cautiously and verify data accuracy.

- API Interface (for large businesses): To minimize errors, consider using the API interface for high‑volume E‑Way Bill generation.

Penalties for Non‑Compliance

Failing to generate a required E‑Way Bill or providing incorrect information can lead to penalties of ₹10,000 or the amount of tax sought to be evaded, whichever is greater. Goods may also be detained, leading to further complications and potential legal action.

Try Kladana for free (14 days are available).

Frequently Asked Questions

Now, let’s briefly explore common questions about the E‑Way Bill.

What happens if an E‑Way Bill is generated, but goods are not transported?

If you generate an E‑Way Bill but do not transport the goods, you must cancel it within 24 hours. It remains valid if not repealed within that time, and any subsequent transport would require a new E‑Way Bill.

Can an E‑Way Bill be generated for consignments of value less than ₹50,000?

Ideally, you’ll need to generate an E‑Way Bill only for consignments exceeding ₹50,000 in value. However, a few categories of goods require an E‑Way Bill even if their value is less than ₹50,000.

These include:

- Inter‑state movement of goods from a principal to a job worker.

- Inter‑state transportation of handicraft goods by a dealer exempted from GST registration.

Can multiple consignments be combined under one E‑Way Bill?

Yes, transporters can generate a consolidated E‑Way Bill for multiple consignments carried in a single vehicle. This consolidation of the E‑Way Bill simplifies the documentation process and helps manage multiple goods in transit more easily.

Can I make changes to the E‑Way Bill after it’s generated?

Yes, you can make specific changes to the E‑Way Bill within 24 hours of its generation or before the initiation of goods movement. You must make these changes through the portal’s ’Update E‑Way Bill’ option. However, changes like changing the vehicle number or GSTIN are not allowed once you update Part B, which contains vehicle identification number (transporter details).

What is the penalty for not generating an E‑Way Bill when required?

Failure to generate an E‑Way Bill when it’s mandatory can attract a penalty of ₹10,000 or the tax sought to be evaded (whichever is greater). Additionally, the goods may be detained, and further penalties may apply.

How are GST details integrated into the E‑Way Bill?

You will need to generate the E‑Way Bill under GST format which requires including fields for capturing GST‑related information. This includes mentioning GSTIN of the supplier and recipient, HSN code, and tax amounts. Such integration ensures that the transportation of goods is aligned with GST regulations and facilitates easier tax calculation and reporting.