Every time your business dispatches goods without an invoice, whether for stock transfers, returns, samples, or job work, you are legally expected to issue a Delivery Challan. This document serves as proof that goods were moved, not sold, and it’s a critical part of staying GST-compliant.

So, if you are still using informal formats or manual notes, you are exposing your business to compliance risks, inaccurate inventory records, and confusion during audits. Using a proper Delivery Challan format in Excel helps you stay audit-ready, standardize documents, and avoid manual errors. It’s beneficial not to use ERP software.

In this guide, you’ll learn how to:

✅ Choose the right Delivery Challan format for different use cases

✅ Download and customize a professional Delivery Challan template

✅ Understand the various types of Delivery Challan based on purpose

✅ Ensure your documents follow all rules under GST

✅ Easily create Delivery Challan entries in Excel or directly through Kladana ERP

✅ Know the difference between a Delivery Challan vs invoice

- Download Free Delivery Challan Format in Excel

- What Is a Delivery Challan?

- When Is a Delivery Challan Issued?

- What is a Returnable Delivery Challan?

- Types of Delivery Challans

- Delivery Challan vs Tax Invoice: Key Differences

- Requirements under GST for Delivery Challans

- Key Fields in a Delivery Challan

- How to Create a Delivery Challan in Kladana

- Advantages of Using Delivery Challans

- Summary

- Frequently Asked Questions on Delivery Challan Formats and Templates for Excel

- List of Resource

Download Free Delivery Challan Format in Excel

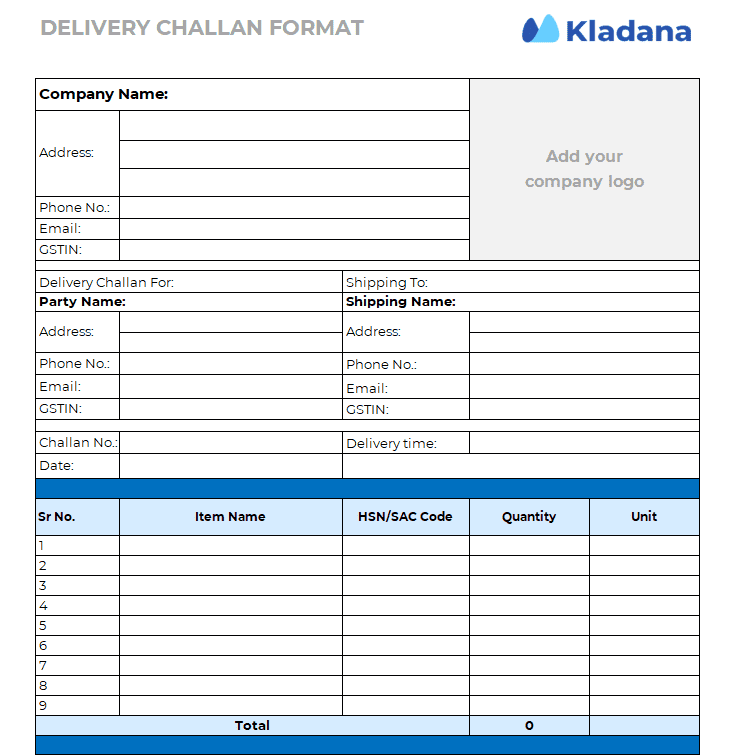

Template Option 1

Before creating a Delivery Challan, it’s a good idea to start with a ready-to-use template that follows GST rules and suits your workflow. Below are free formats that you can download and use immediately, whether you prefer Excel, Word, PDF, or Google Sheets.

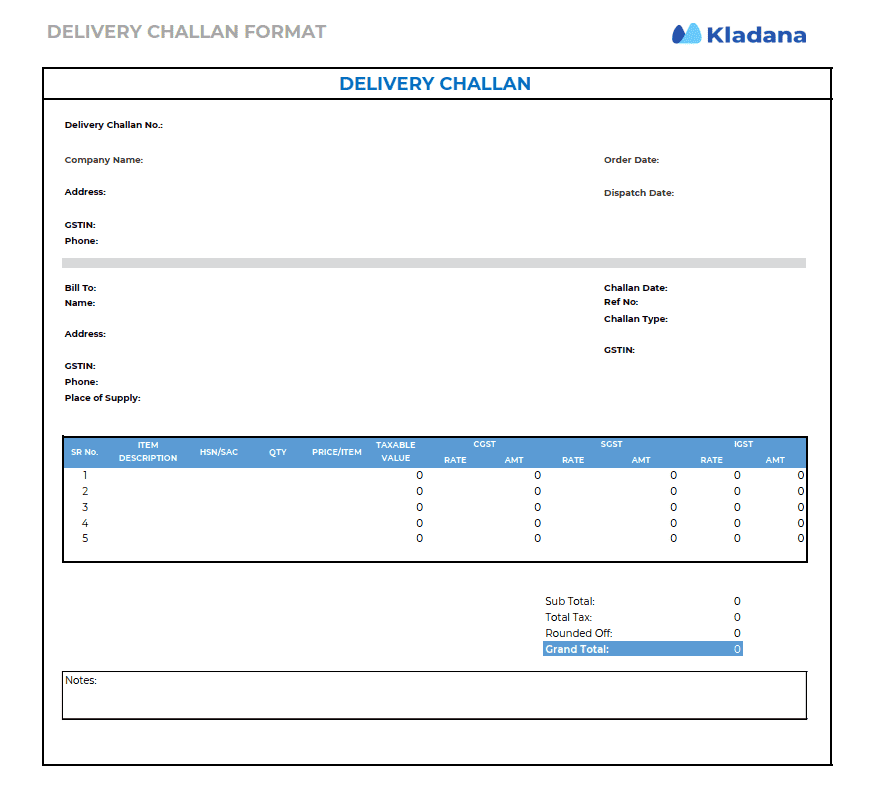

Template Option 2

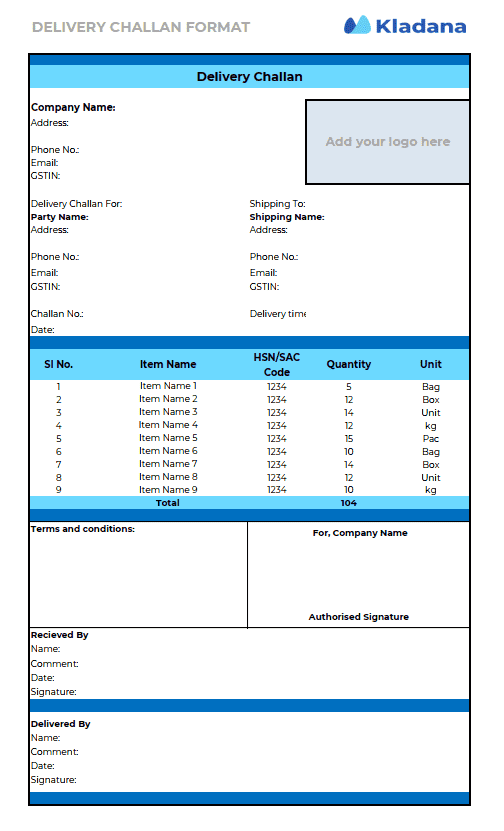

Template Option 3

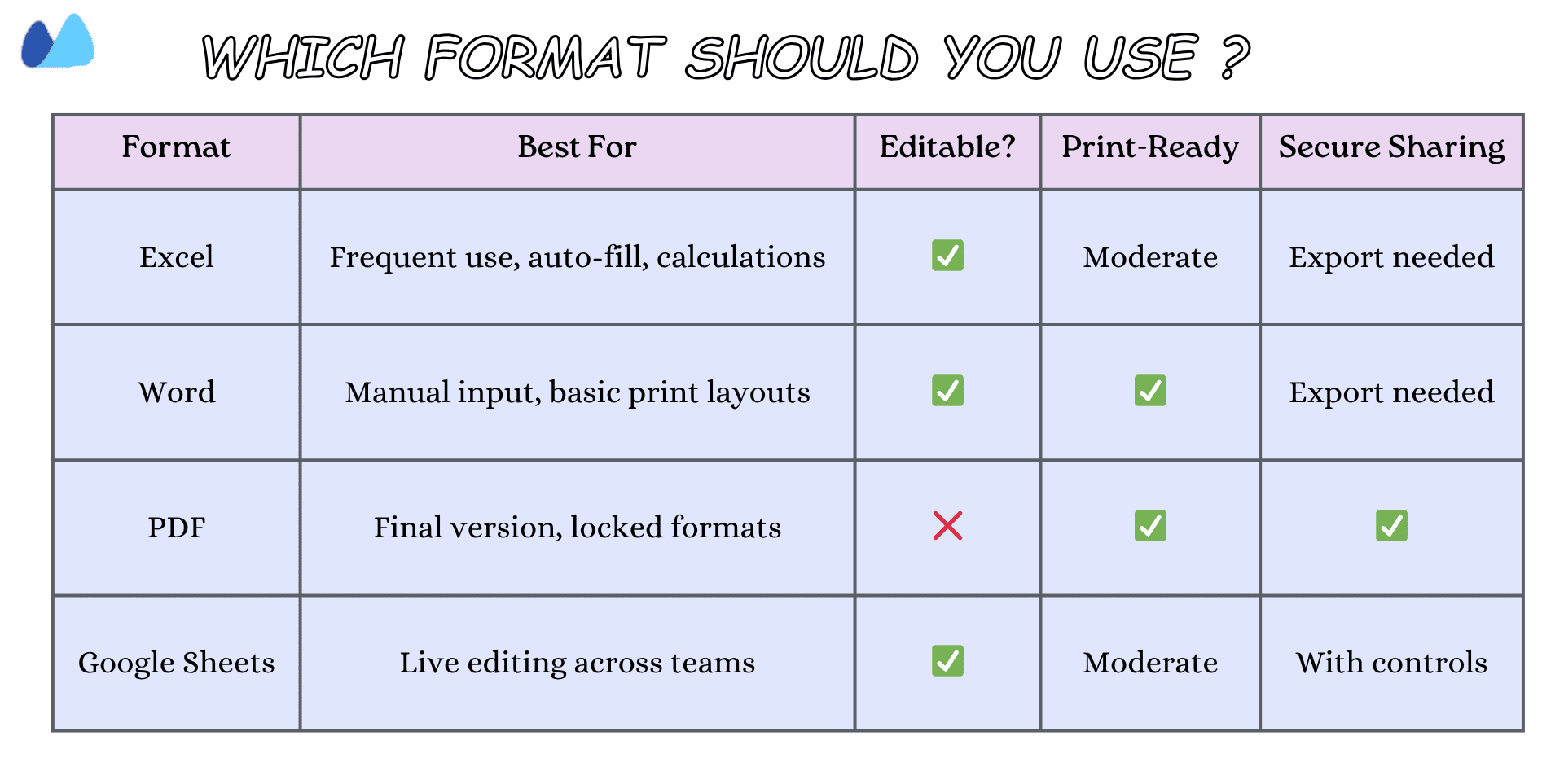

Here’s how each format works and when to use it.

🟩 Excel Delivery Challan Format

Use This if You

|

Best For

|

1️⃣ Download Excel Delivery Challan Template (Option 1)

2️⃣ Download Excel Delivery Challan Template (Option 2)

3️⃣ Download Excel Delivery Challan Template (Option 3)

🟨 Google Sheets Delivery Challan Format

Use This if You

|

Best For

|

1️⃣ Create a copy in Google Sheets (Option 1)

2️⃣ Create a copy in Google Sheets (Option 2)

3️⃣ Create a copy in Google Sheets (Option 3)

📘 Recommended Read: Need a ready-made invoice format too? Check out our Excel GST Invoice Template for free downloads and tips

🧊 4 Free Inventory Ckecklists

Learn how to manage stock, set up your warehouse, track barcodes, and build product cards for e‑commerce — even if you’ve never done it before

✅ Inventory management

✅ Warehouse setup

✅ Barcode tracking

✅ E-commerce product cards

🟦 Word Delivery Challan Format

Use This if You

|

Best For

|

1️⃣ Download Word Delivery Challan Template (Option 2)

2️⃣ Download Word Delivery Challan Template (Option 3)

🟥 PDF Delivery Challan Format

Use This if You

|

Best For

|

1️⃣ Download PDF Delivery Challan Template (Option 2)

2️⃣ Download PDF Delivery Challan Template (Option 3)

What Is a Delivery Challan?

A Delivery Challan is a document that accompanies goods when they’re moved without sale. It serves as proof of dispatch and is especially important in cases where a tax invoice isn’t issued at the time of movement.

Under GST, you must issue a Delivery Challan if you’re:

- Sending goods for job work or testing

- Transferring stock between branches

- Returning goods from customers

- Delivering goods before the invoice is raised

When Is a Delivery Challan Issued?

A Delivery Challan is issued when you send goods from one place to another, but you’re not selling them yet. This means no invoice is raised at the time of dispatch, but the movement must still be documented.

Below are the key situations where you’re required to issue a Delivery Challan.

1. Stock Transfer

If you’re moving goods between your locations, such as from a manufacturing unit to a warehouse, no sale is involved; however, the movement must still be documented.

Why use a Delivery Challan?

Because internal transfers still require physical and legal proof of movement, mainly if GSTINs differ by location.

2. Job Work

You might send raw materials or semi-finished goods to a third party for processing or repair.

Why use a Delivery Challan?

Since job work falls under non-sale movement as per GST, you still need to track dispatches and returns.

3. Deliver Goods before Invoicing

There are cases where goods are dispatched before final billing, such as sales on approval or demo-based deals.

Why use a Delivery Challan?

Because you can’t issue a tax invoice yet, but the goods are already in transit.

4. Goods Are Returned or Exchanged

If a customer returns goods or you send replacements, you are not creating a new sale, but you are still responsible for tracking that movement.

Why use a Delivery Challan?

Because neither a credit note nor an invoice applies unless there’s a refund or billing adjustment, and yet stock is still moving.

5. Goods Sent on Consignment or Loan

If you are sending goods to dealers or retail agents to sell on your behalf or lending items for exhibitions, these aren’t billed right away.

Why use a Delivery Challan?

Because consigned goods remain in your inventory until sold, and loaned goods are expected to be returned.

What is a Returnable Delivery Challan?

A returnable Delivery Challan is used when goods are sent temporarily for a specific purpose. It is not for sale, but with the explicit intention that they’ll come back to you.

This type of Challan helps maintain a legal and auditable trail of goods that are still owned by you but are physically located elsewhere for a short period.

Here are the most common use cases — each governed by GST Rule 55.

1. Repair or Servicing

When machinery or parts are sent to a third party for inspection, testing, or repair, a returnable Challan is used to document the dispatch and ensure traceability upon the item’s return.

2. Demo or Sample Dispatches

When you provide trial units or samples to clients for evaluation, they are not billed initially. A returnable Challan documents this movement until the buyer confirms acceptance.

3. Loan Equipment

When tools, measuring devices, or machinery are temporarily lent to staff, franchisees, or contractors for project work, a returnable Challan ensures that these are appropriately tracked and accounted for in your stock records.

4. Reusable Packaging Material

If goods are dispatched in containers, bins, or drums that are intended for later collection, the packaging itself must be documented as a returnable asset using a Challan.

Types of Delivery Challans

According to the law, you must use different types of Delivery Challan depending on the reason for moving the goods. Each type has its purpose, structure, and compliance requirement.

Let’s explore each one in depth.

1. Job Work Delivery Challan

This Delivery Challan is used when you send goods to an external party for further processing, fabrication, or finishing without raising an invoice. Since the goods are not sold, but only sent for work. So, a Delivery Challan is mandatory to document the movement.

Under section 143 of the CGST Act, such goods can be sent without payment of GST, provided they are returned within:

- 1 year for inputs

- 3 years for capital goods

2. Stock Transfer Delivery Challan

This Delivery Challan is used when goods are moved internally between different units, warehouses, or branches of the same business. A Delivery Challan helps you document and track such non-sale stock movements.

Under Section 25 of the CGST Act, if branches are registered separately under GST, for example, in different states, they are treated as distinct persons. As a result:

- Stock transfers between them are treated as a supply

- You must issue either a tax invoice or a Delivery Challan, depending on whether it’s a taxable transfer or not

- For non-taxable transfers, a Delivery Challan is allowed under Rule 55 of the CGST Rules

3. Standard Delivery Challan

This Delivery Challan is used when goods are dispatched without generating an invoice. It’s suitable for one-time or irregular scenarios where goods are sent in advance, but payment or invoicing will occur at a later time.

Under Rule 55 of the CGST Rules, you can issue a Delivery Challan instead of a tax invoice, such as:

- Goods are sent on an approval basis

- Goods are part of a bulk order

- Products are sent for demo, inspection, or customer testing before sale

4. Consignment Delivery Challan

This Delivery Challan is used when goods are sent to a consignee. The ownership of the goods remains with you until the consignee confirms the sale.

Under Rule 55 of the CGST rules, a Delivery Challan can be used when goods are moved without an invoice, such as:

- Sending stock to retail partners for sale-or-return arrangements

- Placing products at franchise outlets or distributors

- Dispatching goods to the exhibition or promotional counters, where sales may occur later

Delivery Challan vs Tax Invoice: Key Differences

A Delivery Challan is used when goods are moved but not sold. A tax invoice is used when a sale has occurred and GST is applicable.

Here’s a quick comparison below:

| Criteria | Delivery Challan | Tax Invoice |

Purpose |

Records non-sale movement of goods |

Used to bill the customer and collect GST |

GST Applicable |

❌ No GST shown |

✅ GST shown |

When to use |

Stock transfer, job work, samples, and returns |

Final sale, payment collection, and input tax credit |

Legal requirement |

Mandatory for non-taxable under rule 55 |

Mandatory for taxable supply under section 31 of CGST |

Includes pricing? |

❌ No prices or taxes |

✅ Yes, full pricing, tax, and payment terms |

Input tax credit |

Not claimable |

Buyer can claim ITC |

📘 Recommended Read: Ready to switch from Challans to invoices? Explore our complete set of GST invoice templates for Excel, Word, and PDF

Requirements under GST for Delivery Challans

If you are moving goods without sale for stock transfer, job work, or demos, you are allowed to issue a Delivery Challan instead of a tax invoice. But for it to be valid under GST, it must include specific details.

To stay GST-compliant and audit-ready, every Delivery Challan must consist of the following information:

➽ Challan Number and Date: A unique serial number and the issue date for traceability

➽ Consignor & Consignee Details: Name, address, and GSTIN for both the sender and receiver

➽ Description of Goods: Item names with HSN codes, even if GST is not charged

➽ Quantity & Unit: Specify the quantity and measurement

➽ Purpose of Movement: Clearly state the reason

➽ Signature: Signed or digitally authenticated by the issuing authority

➽ Transport Info (optional): Vehicle number, transporter name, and e-way bill (if required)

📌 Is an E-Way Bill Required?

Yes. If the value of goods being moved exceeds ₹50,000, you must also generate an e-way bill along with the Challan. The Delivery Challan number and date must be mentioned in the e-way bill.

📘 Recommended Read: Want to understand e-way bill formats better? Don’t miss our detailed guide on the E-Way bill format

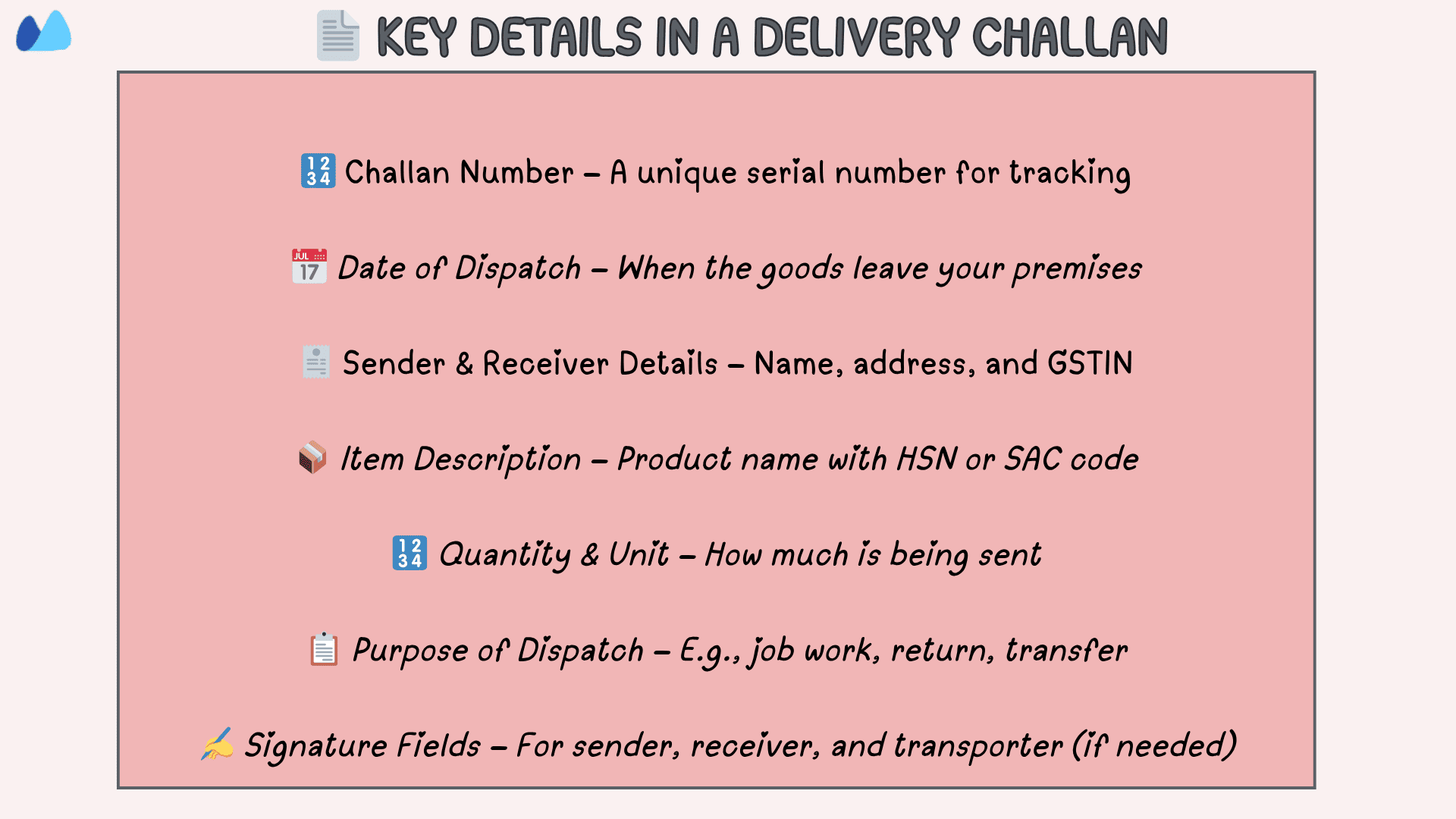

Key Fields in a Delivery Challan

Whether you’re using Excel, Word, or ERP software, your Delivery Challan must include these standard components.

| Sections | Fields to Include |

Header |

|

Sender details |

|

Receiver details |

|

Item table |

|

Dispatch info |

|

Purpose of movement |

|

Signature |

|

Which Format to Choose?

How to Create a Delivery Challan in Kladana

If you are using Kladana ERP to manage shipments or stock transfers, you don’t need to rely on Excel or Word templates to generate Delivery Challans. You can create fully formatted GST-compliant Delivery Challans directly from your system and print or download them instantly.

Let’s walk through the complete setup for generating GST-compliant Delivery Challans using Kladana.

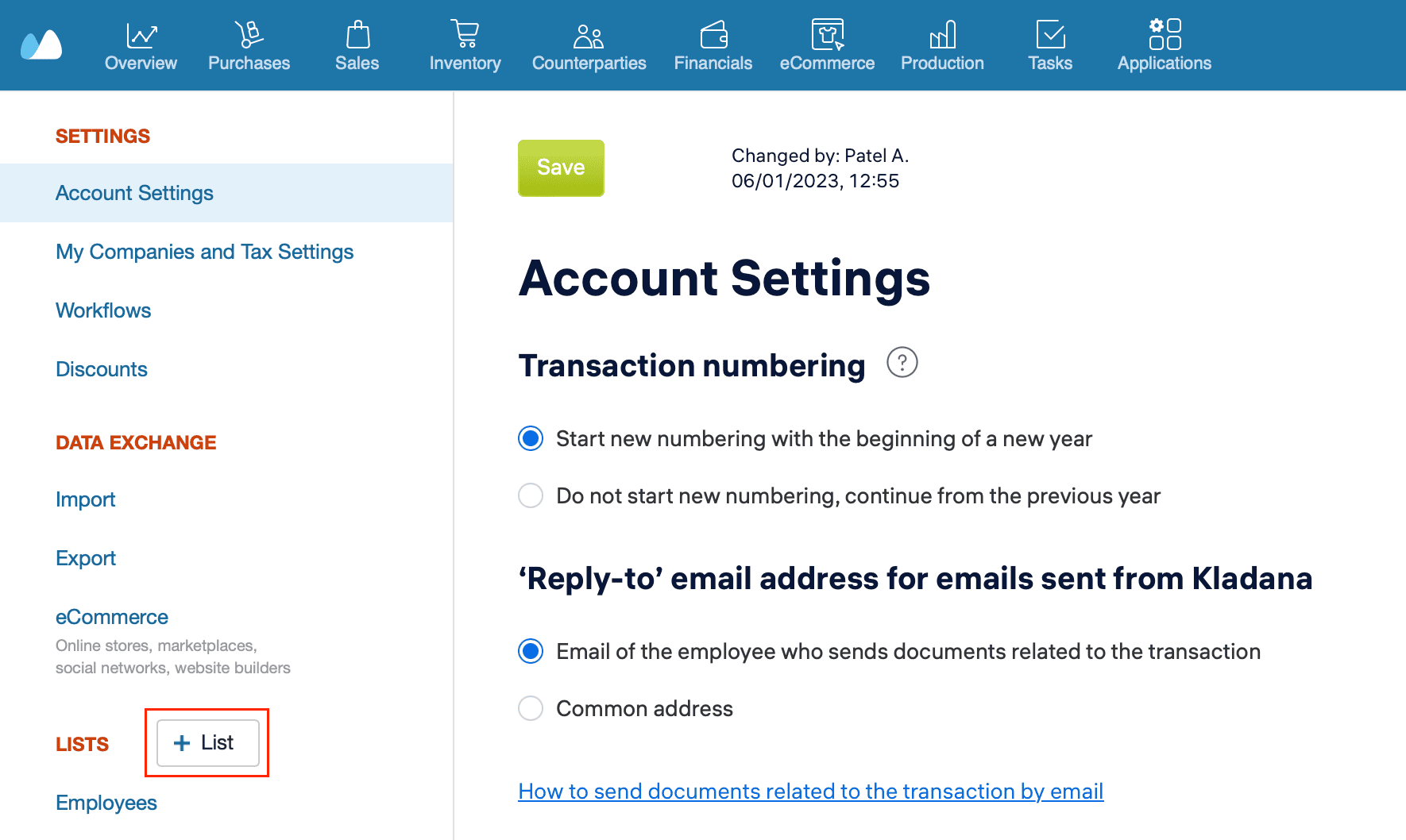

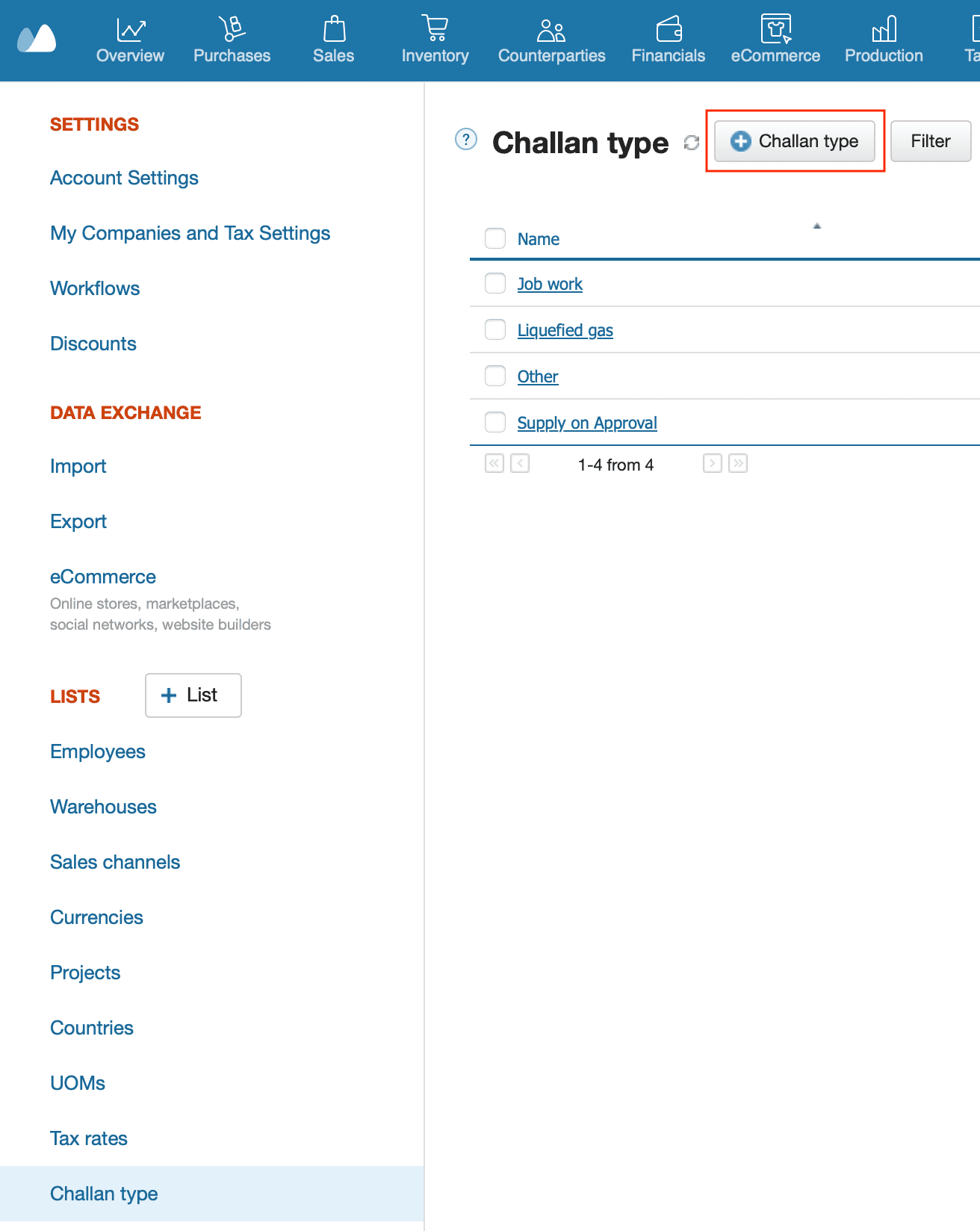

✅ Step 1: Create a List for Challan Types

- Go to your Account icon ➜ Settings

- Click +List and create a new named Challan Type

- Once saved, open and click + Challan Type to add entries like

1. Job work

2. Stock Transfer

3. Sale on Approval

4. Consignment

📍This helps standardize the types of movements you’ll track using Delivery Challans.

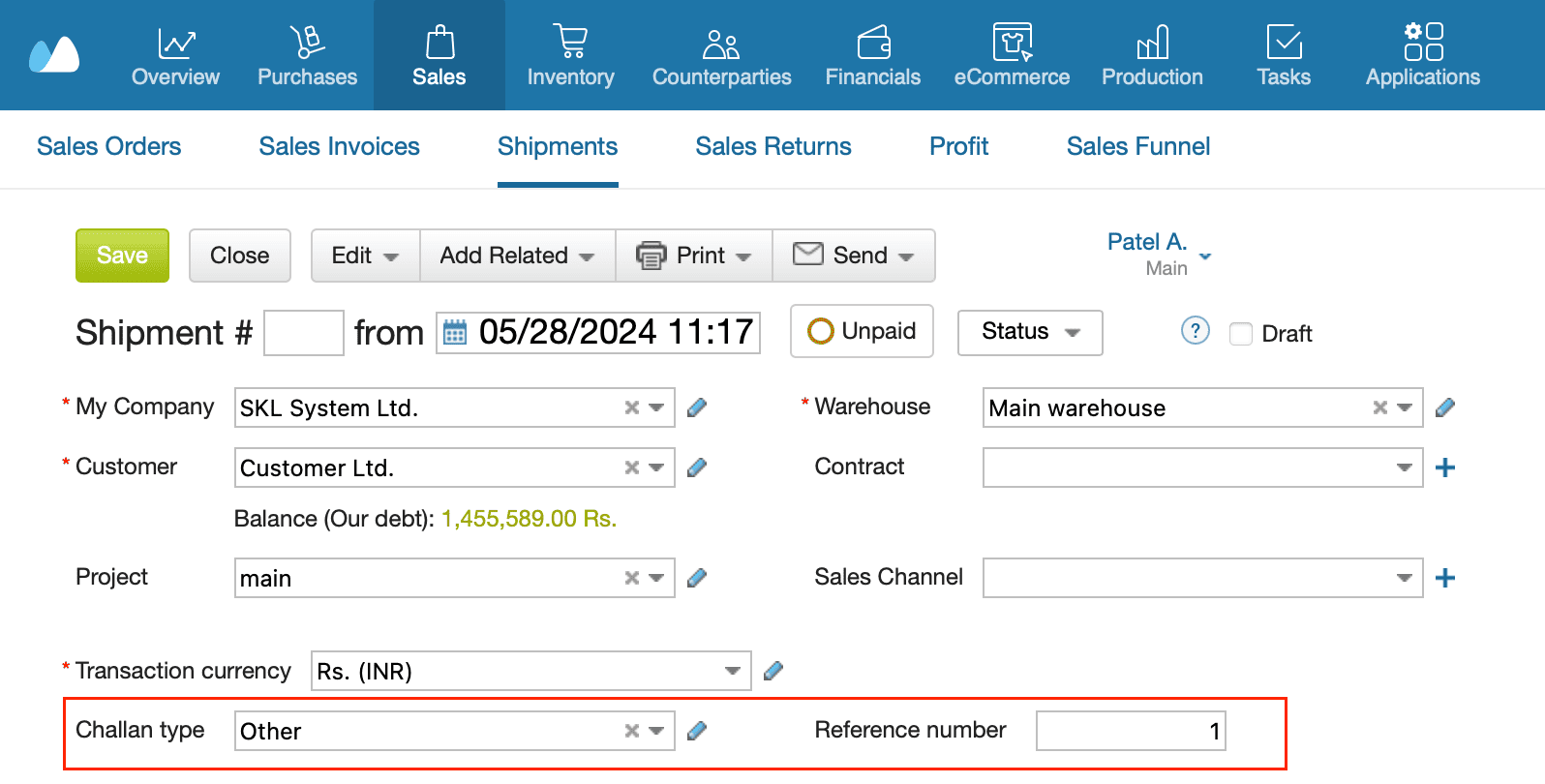

✅ Step 2: Add Custom Fields

- Navigate to sales ➜ Shipments or inventory ➜ Transfers

- Open the settings of that module (not a transaction)

- In the custom fields section, click +Field and create:

a) Challan Type ➜ Field: Dataset, then select Challan Type from the dropdown

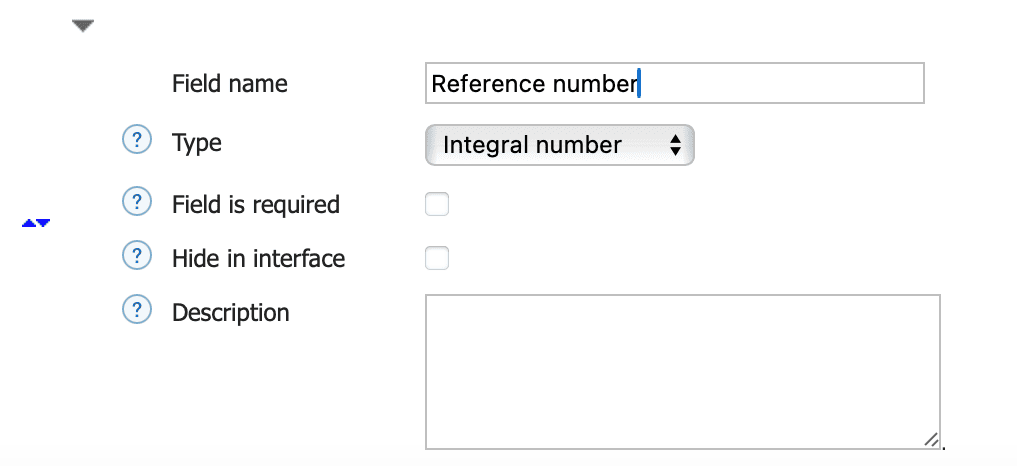

Create a custom field for Delivery Challan Type using the dataset option b) Reference Number ➜ Field Type: Integral Number

- Click save ➜ Kladana will refresh to apply the new fields across all transactions

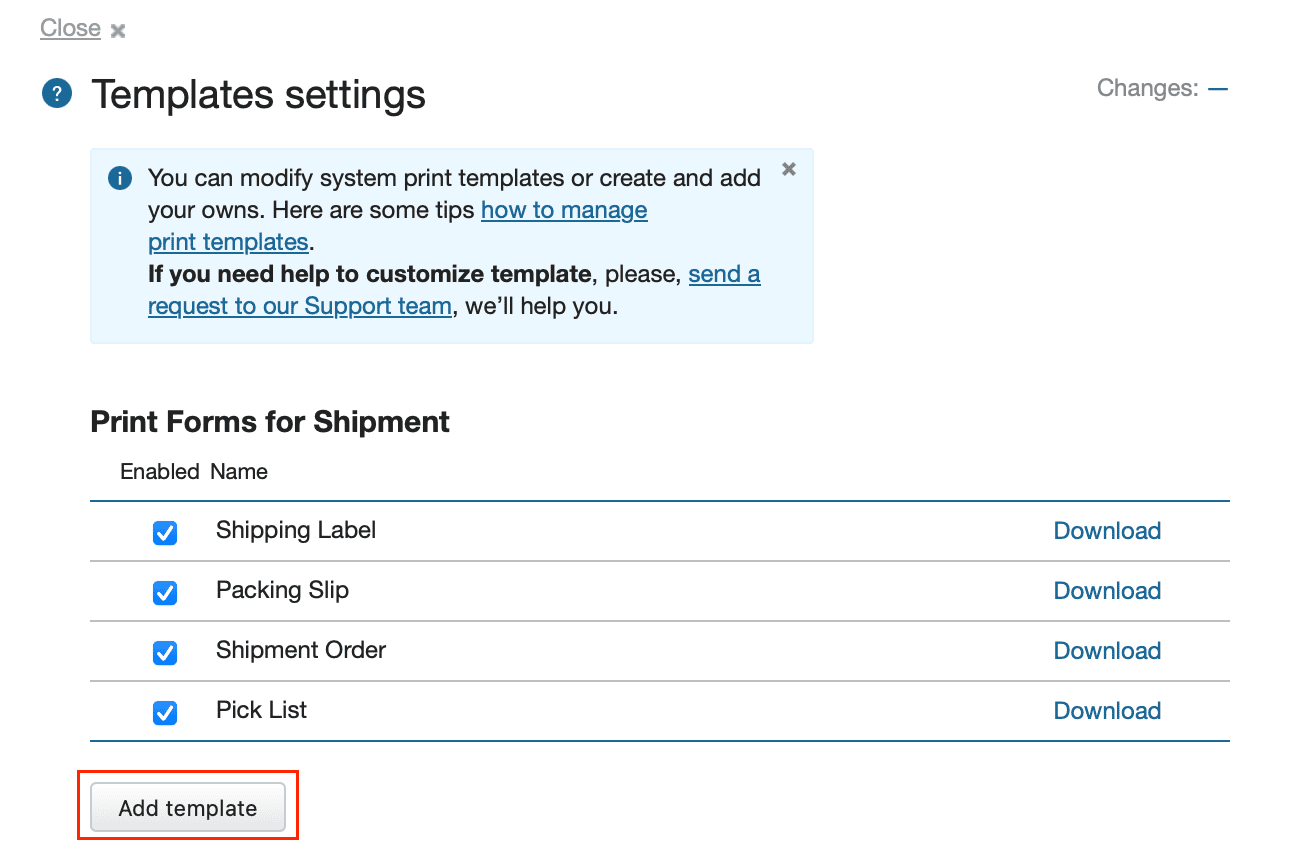

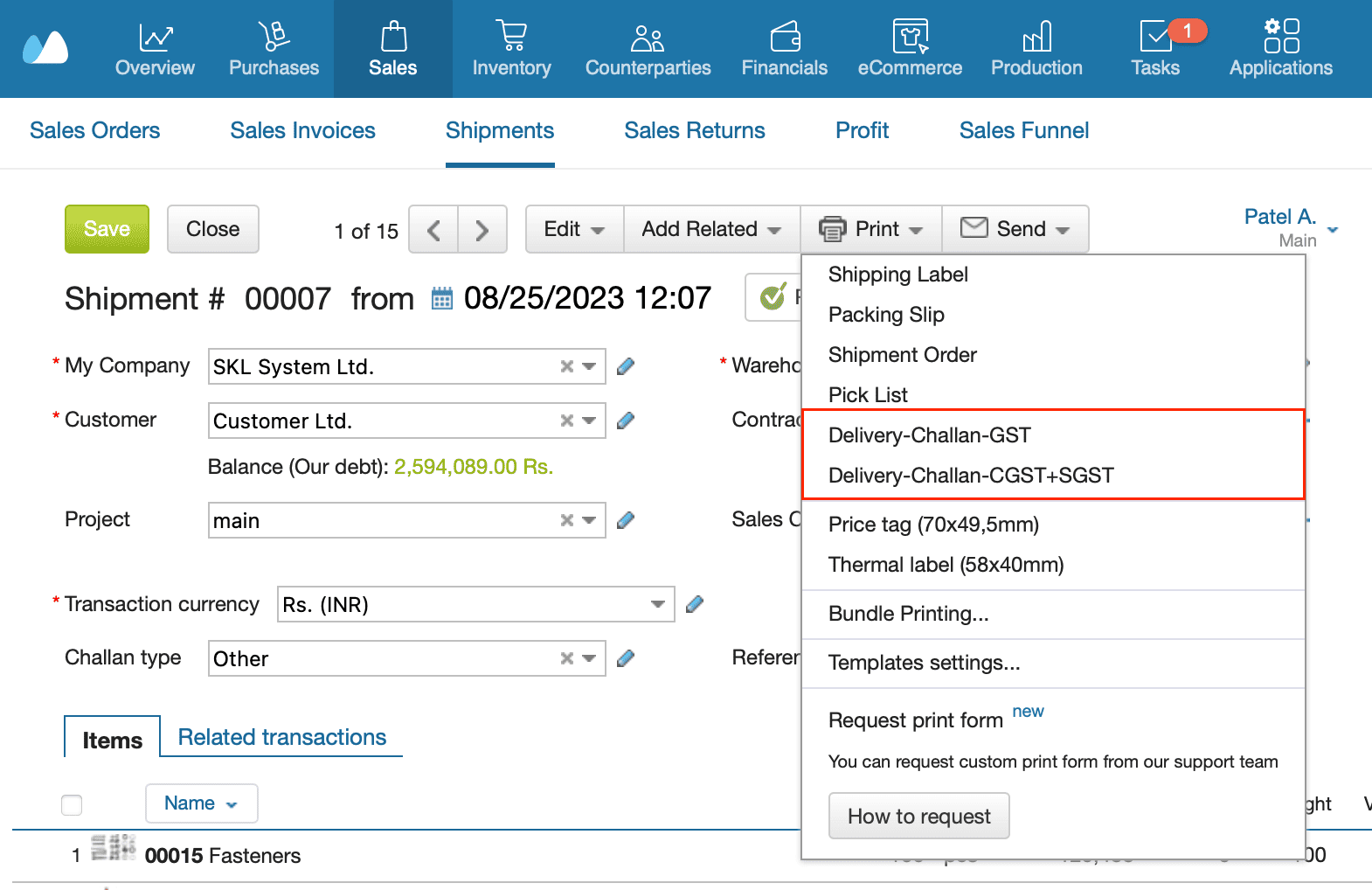

✅ Step 3: Upload a Delivery Challan Print Template

- Go to Sales ➜ Shipments or Inventory ➜ Transfers

- Open any transactions and click print ➜ Template settings ➜ Add template

- Upload the template file for shipments or transfers

- Click save

📍 You can use different templates depending on whether the Delivery Challan is for internal or external movement

✅ Step 4: Create and Print the Delivery Challan

- Click + Shipment for dispatch or + Stock Transfer

- Fill in product details and select the Challan Type

- Add a reference number

- Save the transaction, then click Print ➜ Delivery Challan

- Once done, your formatted, GST-compliant Challan is ready to download, print, or email

Advantages of Using Delivery Challans

Delivery Challans aren’t just about doing paperwork. They bring clarity, control, and compliance to your operations, especially when goods are moved without a sale.

Here are the key benefits.

📦 Clear Proof of Dispatch

Helps you:

- Show when, where, and why goods were moved

- Avoid confusion with customers or vendors

- Track responsibility if shipments get delayed or lost

📊 Better Inventory Control

With every Delivery Challan, you can:

- Match stock movement with your inventory records

- Prevent understocking or overstocking

- Keep warehouse-to-warehouse transfers traceable

📄 GST-Ready Movement

Even without a sale, Delivery Challans help you:

- Stay compliant with Rule 55

- Generate e-way bills if needed

- Separate taxable invoices from returnable or job work items

🔁 Easy to Convert into Invoices

You can:

- Convert a Delivery Challan into a tax invoice with one click

- Skip re-entering the item and quantity details

- Save time when demos, job work, or consignment leads to a sale

🖨️ Professional Presentation

Even in Excel, you can:

- Add your logo, company colors, and layout

- Make your documents look polished and trustworthy

- Create a consistent experience for clients and partners

⚡ From Dispatch to Invoice — Just One Click

Create tax invoices directly from your Delivery Challans in Kladana. No rework. No delays

Summary

Therefore, using the correct Delivery Challan format in Excel will help you achieve complete flexibility, especially if you are just starting or operate manually.

Here’s what to keep in mind:

- Choose the right Delivery Challan type

- Use templates that include all GST-required fields

- Maintain a serial record of all Delivery Challans issued

Frequently Asked Questions on Delivery Challan Formats and Templates for Excel

What is a Delivery Challan, and when is it used?

A Delivery Challan is a document used to record the dispatch of goods without an actual sale. Whenever goods are moving, no invoice has been raised yet.

What’s the difference between a Delivery Challan and an invoice?

A Delivery Challan only documents the movement of goods. It doesn’t show price or tax. An invoice, on the other hand, is issued when a sale happens and includes GST, payment terms, and the total amount payable.

Is it mandatory to issue a Delivery Challan under GST for non-sale movements?

Yes. Under rule 55 of the CGST rules, if goods are being moved without a sale for job work, repair, demo, etc. You must issue a Delivery Challan instead of an invoice.

Is a Delivery Challan mandatory?

Yes, whenever you are moving goods without generating an invoice. It serves as legal proof of movement and helps in audit and compliance.

What info must be in a Delivery Challan?

Your Delivery Challan should include:

- Challan number and date

- Sender and recipient details with GSTIN

- Item description with quantity and HSN

- Reason for movement

- Signature of the sender or digital authentication

How can I issue one using Kladana?

You can issue a Delivery Challan in Kladana in four quick steps:

- Set up the Delivery Challan type as a custom list

- Add custom fields (Challan Type& Reference No.) in shipment or transfer

- Upload your Delivery Challan template under print settings

- Create a shipment or transfer, select the Delivery Challan type, and print the Delivery Challan directly

What is a returnable Delivery Challan, and how is it different?

A returnable Delivery Challan is used when goods are sent temporarily and are expected to be returned, such as machinery for repair, demo items, or reusable containers. It is worth mentioning that the goods are returnable, and the purpose should be specified.

Can I use Excel to create a Delivery Challan format that’s GST compliant?

Absolutely. Excel is one of the most flexible tools for creating Delivery Challans. You can add GST-required fields, such as HSN code, Delivery Challan number, quantity, and purpose of dispatch, and reuse the format easily.

Can I issue a Delivery Challan for consignment stock or loaned goods?

Yes. If you’re sending goods to a dealer, exhibition, or franchise on consignment or loan. You should issue a Delivery Challan mentioning the dispatch purpose clearly, like “Consignment Basis” or “Loaned Equipment”

How do I convert a Delivery Challan into a tax invoice?

Once the goods are accepted or the sale is confirmed, you can use the details from the Delivery Challan to create a tax invoice.

List of Resources

- GST Tax Invoice: Importance of Tax Invoice under GST

- GST Act: Section 31, 25, 55

Read‑alikes

Transport Bill Format: Free Excel, Word, and PDF Templates for Logistics and Trucking Companies

How To Create a Quotation Format In Excel, That’s GST Ready, Error-Free, and Built for Scale

Quotation Format In Word: Free Templates for Freelancers, SMEs & MSMEs, Step-By-Step Guide

Sales Report Templates: Tips, Examples, and 4 Free Downloads in Excel, Word, PDF, and Google Sheets